Do I really have to point them outAbove the so-called doomsayers were accused of “repeating the same tropes for decades” and “having no skin in the game.” @grapedrink could you please say who the doomsayers on this thread are and what you mean by “repeating the same tropes for decades” and “having no skin in the game.”

Again, there is the sandbox that we play in where most of us consider the same handful zip codes desirable, and then there is the rest of the country who live in $100-300k homes. The former is not bound to fundamentals because there are a lot of high net worth individuals who can afford to live wherever they want, and there are only so many properties in these desirable zip codes. Whereas the rest of the country has plenty of houses, room to grow, and is cheaper/easier to build.I do. The BLS publishes a wage distribution and there are other estimates of household net worth distribution, including the amount of consumer debt and student loan debt and savings. These are the types of data you’d use to say that the fundamentals had improved enough to drive the housing price increases we’ve seen.

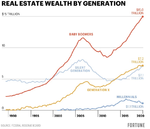

Funny, because they seem to be making it work. Sky is falling.I’ve looked at this data and it’s all bad for Millennials and they carry in the neighborhood of 2-3 trillion in student loan debt the size of a mortgage down payment on average. Also, wages have been stagnant for the bottom 3/5ths of earners since the ‘90s. About the only “fundamentals” I sawimproving over the past 2 years were for thhose in the top 20% who are compensated partially or wholly in stock.