if you cant make it work on 350k even in NY or LA, youre the problem, not whatever financial crisis we are or arent headin into.

Open main menu button

REMINDER: THE ARENA PLATFORM, INC. has no obligation to monitor the Forums. However, THE ARENA PLATFORM, INC. reserves the right to review any materials submitted to or posted on the Forums, and remove, delete, redact or otherwise modify such materials, in its sole discretion and for any reason whatsoever, at any time and from time to time, without notice or further obligation to you. THE ARENA PLATFORM, INC. has no obligation to display or post any materials provided by you. THE ARENA PLATFORM, INC. reserves the right to disclose, at any time and from time to time, any information or materials that we deem necessary or appropriate to satisfy any applicable law, regulation, contract obligation, legal or dispute process or government request. Click on the following hyperlinks to further read the applicable Privacy Policy and Terms of Use.

How’s the stock market?

- Thread starter lagunaboy

- Start date

This is so fucking revolting. Where do I check everything she buys anyway? You can blindly throw money at anything she invests it's 100% gonna pay off... As long as you time it right.We missed it, bros!

View attachment 139385

This is just like playing Drug Wars on the TI-86 calculator!

This is so fucking revolting.

Where do I check everything she buys anyway? You can blindly throw money at anything she invests it's 100% gonna pay off... As long as you time it right.

Last edited:

LUUUUUUDESSSS!We missed it, bros!

View attachment 139385

This is just like playing Drug Wars on the TI-86 calculator!

Unconfirmed, and that guy posts a lot of bullshit for clicks.We missed it, bros!

View attachment 139385

This is just like playing Drug Wars on the TI-86 calculator!

Would not be surprising though.

House Stock Watcher - See What Your Representative Is Trading

Updated Daily - See the stock trades US Representatives are making as they are reported. Get notifications when new reports are uploaded. Get insight now!

who, PRCD or the author of the tweet? untrue, according to Stock Watcher.Unconfirmed, and that guy posts a lot of bullshit for clicks.

These are most likely lies.Decent Payroll data.

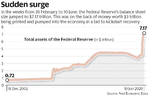

They won't hike b/c it will trigger a sovereign debt crisis.More ammunition for the FED to keep hiking.

November will tell. I think it's curious how the UN seems to have a problem with the rate hikes while they didn't care one bit while countries were printing copious amounts of money in such a short time.These are most likely lies.

They won't hike b/c it will trigger a sovereign debt crisis.

IMO the FED will raise at least 50 basis points... at least.

i think nancy should buy herself some weed

Short term thinking and no ability to see long-term causality.November will tell. I think it's curious how the UN seems to have a problem with the rate hikes while they didn't care one bit while countries were printing copious amounts of money in such a short time.

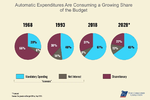

This will increase the interest on the debt that was used to print the money over the last two years. Increasing interest payments on sovereign debt crowds-out mandatory entitlements in budgets. 75% of USG budget, for example, is automatic. IOW, there's no room in the budget to spend more on debt due to rate hikes.IMO the FED will raise at least 50 basis points... at least.

The gray part of the pie will increase too much with more rate hikes.

Last edited:

Regardless the payroll data has sent the SP500 to leak the floor. Might just be a huge bear trap though. Will we see a pumpctober?

Yeah but you get to pay down that debt with cheaper inflated dollars. Prob a wash in the end.Short term thinking and no ability to see long-term causality.

This will increase the interest on the debt that was used to print the money over the last two years. Increasing interest payments on sovereign debt crowds-out mandatory entitlements in budgets. 75% of USG budget, for example, is automatic. IOW, there's no room in the budget to spend more on debt due to rate hikes.

View attachment 139411

The gray part of the pie will increase too much with more rate hikes.

it was a rhetorical question.No idea.

I got $125 Meta puts that are currently printing. They expire Oct 21st (don't know why on Earth I chose that date earlier this year). Do we got more to go down? Should I sell at open Monday?

I also got $120 Meta puts that expire Dec 23rd that are printing nicely as well. Gonna sell 25% of those and ride the rest.

I also got $120 Meta puts that expire Dec 23rd that are printing nicely as well. Gonna sell 25% of those and ride the rest.