I think BABA is going to get absorbed by the CCP borg. There's a new game, "Where's Jack Ma?". Dude has been hidden for months. CCP don't like those uppity capitalists getting too big...my thoghts

100%. due to the CCP's meddling, it's like getting a chance to buy Amazon in the early ought's

Open main menu button

REMINDER: THE ARENA PLATFORM, INC. has no obligation to monitor the Forums. However, THE ARENA PLATFORM, INC. reserves the right to review any materials submitted to or posted on the Forums, and remove, delete, redact or otherwise modify such materials, in its sole discretion and for any reason whatsoever, at any time and from time to time, without notice or further obligation to you. THE ARENA PLATFORM, INC. has no obligation to display or post any materials provided by you. THE ARENA PLATFORM, INC. reserves the right to disclose, at any time and from time to time, any information or materials that we deem necessary or appropriate to satisfy any applicable law, regulation, contract obligation, legal or dispute process or government request. Click on the following hyperlinks to further read the applicable Privacy Policy and Terms of Use.

How’s the stock market?

- Thread starter lagunaboy

- Start date

even though i'm up for holding Baba long term, this is still maddening: a couple of Wall Street Banks come out and basically downgrade it from "awesome" to "great" and the stock drops a few more points, even though it's trading at something like 60% of it's price target and is still considered overweight.my thoghts

100%. due to the CCP's meddling, it's like getting a chance to buy Amazon in the early ought's

fwiw, i bought it back in the summer for $187 because the financials looked awesome then, to my untrained eye. now, at $144, it looks even better, which puts me in the classic dilemma of wondering if i should be doubling down and buying more. i should actually just stop looking at it for a few months

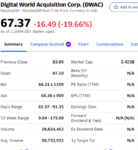

let's see... The DWAC CEO has an address in Wuhan, Hubei ....The CFO is a CURRENT congressman in Brazil....The Trump TRUST Social product doesn’t even exist. MAGA!

WCGW?

even though i'm up for holding Baba long term, this is still maddening: a couple of Wall Street Banks come out and basically downgrade it from "awesome" to "great" and the stock drops a few more points, even though it's trading at something like 60% of it's price target and is still considered overweight.

fwiw, i bought it back in the summer for $187 because the financials looked awesome then, to my untrained eye. now, at $144, it looks even better, which puts me in the classic dilemma of wondering if i should be doubling down and buying more. i should actually just stop looking at it for a few months

View attachment 117067

BABA is $177 right now. You buy at 144?

BX keeps delivering.

Other good long performers:

GDV, RFI, GM, AEP, PFE

Other good long performers:

GDV, RFI, GM, AEP, PFE

I bought 5 shares at 148. I could take a few hundred profit and pay my cable bill, but I think Ali baba is a $1000 stock in the not so distant futureBABA is $177 right now. You buy at 144?

i did not but i think Subway bought somewhere in that neighborhood. i thought it was wildly undervalued back in the summer so i bought 20 shares each in July: Baba @ $187 and Bidu @ $169. up 5% on Bidu, still down about 6% on Baba, but they are both coming back steadily.BABA is $177 right now. You buy at 144?

it's been really tempting to buy more and obviously in hindsight, i should have....but it's a contrarian play with some risk and $8k was about as much money as i wanted to roll the dice with on Chinese tech. nevertheless, i agree with Subway that Baba is very much like buying into Amazon 10 or 15 years ago and the upside is huge. it's a long term bet and i feel good about it.

Damn when you put it like that I may buy another 5 sharesi did not but i think Subway bought somewhere in that neighborhood. i thought it was wildly undervalued back in the summer so i bought 20 shares each in July: Baba @ $187 and Bidu @ $169. up 5% on Bidu, still down about 6% on Baba, but they are both coming back steadily.

it's been really tempting to buy more and obviously in hindsight, i should have....but it's a contrarian play with some risk and $8k was about as much money as i wanted to roll the dice with on Chinese tech. nevertheless, i agree with Subway that Baba is very much like buying into Amazon 10 or 15 years ago and the upside is huge. it's a long term bet and i feel good about it.

The warrants, DWACW went from 0.47 to a high of 79.22 in 2 days, if one were extremely disciplined, skilled, patient, lucky, they could have turned 5k into 843k, in 2 days. The warrants intrinsic value should only trail the common price by 11.50, so still some serious discrepancy there for whatever that is worth.

I trade SPAC warrants as a large part of my strategy, there can be massive upsides with little risk. Just have to be aware of the warrant terms, and the fact that they lack the same liquidity as common shares.

Options go live on Monday on the common shares, that should be interesting, can't wait to see what the IV will be on those. Obviously this isn't investment advice, but with the cult effect, 900m volume on a 30m float stock, national news.....follow the volume/order flow, lots of money to be made on these momentum trades. These opportunites don't come around often. Retail traders probably won't be able to locate any shorts to borrow, but this is probably one of those that being short can absolutely put one in ruins, as well as being long during a halt down if you go big.

YEW.

Not really.The warrants, DWACW went from 0.47 to a high of 79.22 in 2 days, if one were extremely disciplined...

maybe slightly....skilled...

not at all...patient...

Only occasionally. With that kind of volatility, clearly there is money to be made, but not by me....lucky...

the whole thing looks radioactive, with pretty much every red flag imaginable.

the whole thing looks radioactive, with pretty much every red flag imaginable.Disciplined....yes, watch order flow, volume, trade accordingly, no emotions. Don't sell a runner for minimal gains, cut losers quickly when volume starts drying up.Not really.

maybe slightly

not at all

Only occasionally. With that kind of volatility, clearly there is money to be made, but not by me.the whole thing looks radioactive, with pretty much every red flag imaginable.

Skilled...absolutely. See above.

Patient, definitely. The pre-definitive agreement SPAC warrants trade in the cents. Once rumors break or an announcement for a target, they can have tremendous parabolic moves depending on the deal. Even crappy undesirable deals the warrants will gain over 100% rather quickly. This is obviously one of the more tremendous and not normal, but not unheard of either. Lucid was another where the warrants were trading sub dollar, and topped out at almost 50. There are many others where 1000's of % were gained in the warrants buy buying them pre DA and holding patiently.

I don't disagree on this particular deal being shady, that is the difference between trading and investing. Who cares what they do or the toxicity of the deal, follow the volume and order flow, trade it, bank it. I certainly wouldn't hold any of that over night....

Those DWAC-w warrants, the day before any news broke, had a very unusual volume uptick and went from 0.40 to 0.47 on around 1m in volume, when it barely had any volume. Someone knew, the warrants tend to catch some heat prior to the commons once things start brewing behind the scenes. One can monitor warrant volume behavior and learn a lot about the future..Not really.

maybe slightly

not at all

Only occasionally. With that kind of volatility, clearly there is money to be made, but not by me.the whole thing looks radioactive, with pretty much every red flag imaginable.

interesting to know. i obviously don't know much about these financial instruments but you've piqued my interest. would have no interest in investing here but would not walk away from a good trade, if i understood it completely. will investigate this subject further - thanksThose DWAC-w warrants, the day before any news broke, had a very unusual volume uptick and went from 0.40 to 0.47 on around 1m in volume, when it barely had any volume. Someone knew, the warrants tend to catch some heat prior to the commons once things start brewing behind the scenes. One can monitor warrant volume behavior and learn a lot about the future..

edit: obviously, you're a day trader - i am not. when approaching semi-retirement a couple years ago, i looked at day trading long and hard as a possible income stream, studied this and that etc. it was Andrew Aziz's book How To Day Trade For A LIving that talked me right out of it...convinced me I had neither the discipline or the focus to do it successfully. swing trading is more my speed.

Last edited:

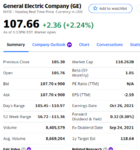

Flex time!At $7 a share, I like to think of these as long term options that don't expire. They might break up, though I don't see bankruptcy, but it isn't like I have $20K to make that bet. Maybe in 10 years, I'll wonder if I shouldn't have just stuck with tulip bulbs.

View attachment 97902

With the 8-1 reverse split that happened this summer, the 200 shares of GE at $7.06 ($1412) means that I more or less bought 25 shares at $56.

Good news this morning (better than expected earnings) has the price around $107-108.

So it appears I have a 85% gain in a 13 months time.

Am thinking there is more in the tank in the coming years. Will hold my meager position because $2600 isn't going to buy me much.

Please note, me bragging means financial crisis is imminent, misfortune will soon have me gnashing my teeth, decrying the house of cards that is the financial markets.

Another case of the SPAC/warrant potential, BKKT-WS went up over 800% today....BKKT commons went up 500%.

congrats!Flex time!

With the 8-1 reverse split that happened this summer, the 200 shares of GE at $7.06 ($1412) means that I more or less bought 25 shares at $56.

Good news this morning (better than expected earnings) has the price around $107-108.

View attachment 118381

So it appears I have a 85% gain in a 13 months time.

Am thinking there is more in the tank in the coming years. Will hold my meager position because $2600 isn't going to buy me much.

Please note, me bragging means financial crisis is imminent, misfortune will soon have me gnashing my teeth, decrying the house of cards that is the financial markets.

that fvcking GE. a few years ago, when i was somewhat younger and lot dumber, i looked at GE and thought, for no apparent reason, that $14 something per share for a big company like that sounded pretty cheap, so i bought 8 or 10 shares....and i have been underwater ever since. it's not the money, obviously, but it's a sore point nonetheless. that reverse split (and i thought it was 10-1 but it doesn't matter) left me with 1 - one! - fvcking share of GE, with a cost basis of $119.11, that hangs around my neck like an fvcking albatross, doomed to be forever unprofitable. ymmv.

Last edited: