Why are all the right leaning gay lockdown never forgetters such Luddites?

EVs have 1/3 the footprint and the batteries are recyclable.

REMINDER: THE ARENA PLATFORM, INC. has no obligation to monitor the Forums. However, THE ARENA PLATFORM, INC. reserves the right to review any materials submitted to or posted on the Forums, and remove, delete, redact or otherwise modify such materials, in its sole discretion and for any reason whatsoever, at any time and from time to time, without notice or further obligation to you. THE ARENA PLATFORM, INC. has no obligation to display or post any materials provided by you. THE ARENA PLATFORM, INC. reserves the right to disclose, at any time and from time to time, any information or materials that we deem necessary or appropriate to satisfy any applicable law, regulation, contract obligation, legal or dispute process or government request. Click on the following hyperlinks to further read the applicable Privacy Policy and Terms of Use.

Why are all the right leaning gay lockdown never forgetters such Luddites?

Why are all the right leaning gay lockdown never forgetters such Luddites?

Do you guys own EVs?Spolied insecure children who cannot deal with change. If they cannot have things exactly as they want them r they will ruin it for everyone else.

No, but not against the tech. Just not an early adopter with anything, "pioneers catch arrows"Do you guys own EVs?

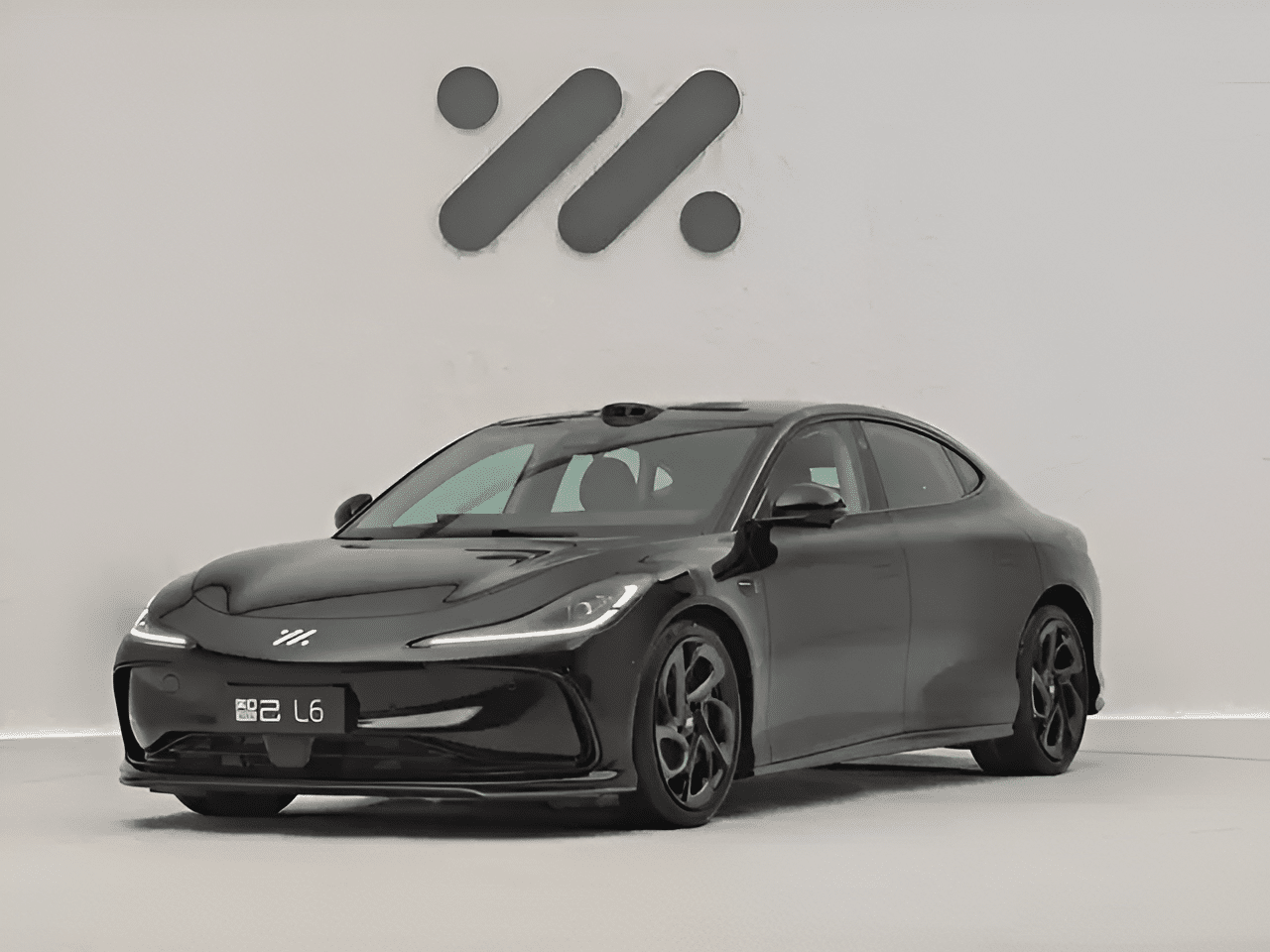

I have a deposit on the fish car.Do you guys own EVs?

Everything is recyclable. The only issue is cost.EVs have 1/3 the footprint and the batteries are recyclable.

you’re oversimplifyingEverything is recyclable. The only issue is cost.

If you wank, you're a looser degenerate and EVs suck.Why are all the right leaning gay lockdown never forgetters such Luddites?

When you work on an EV, you have to tape everything off and put on lineman gloves and boots due to the high voltages. Probably a huge, expensive liability headache.Not the first time I've heard that repairing and maintenance costs of EV's is higher than ICE's.

Likely because of lack of competitive pricing/availability for replacement parts due to scarcity.

Someday spare parts will be more available, but for now, not so much.

Just don't get any fender benders, and you're good. Insurance will save you, if you don't have high deductibles.

Racist!!!!!!!!!"pioneers catch arrows"

Where have you heard that?Not the first time I've heard that repairing and maintenance costs of EV's is higher than ICE's.

Likely because of lack of competitive pricing/availability for replacement parts due to scarcity.

carnewschina.com

carnewschina.com

Except when it didn’t.I’ll just leave this here…

More and faster: Electricity from clean sources reaches 30% of global total

A record 30% of global electricity was generated from renewables in 2023, according to a report released by Ember, a think tank based in London.apnews.com