I said that in this thread in response to Casa's list of reasons why the crash is imminent. I called it FUD, because that's exactly what it is, especially when those bullet points lack the full context of the other confounding factors and are framed in a 100% negative light. In addition to being the same exact talking points that goldbug doomsayers have been saying for the last 20+ years.

Which doesn't mean that they aren't true, however a lot of things are not unique to this era either, such as credit card/household debt.

You posted it in the "Water is about to get more crowded" thread. I copied the points below and rated them.

Unemployment will be high (Leading off with speculation? It's not high right now - Grapeboi 1 MoogZ 0)

Household debt is massive (1-all)

Interest rates up up up (MoogZ 2 Grapeboi 1)

Low rates have meant this country is leveraged out the wazoo in all aspects. (MoogZ 3 Grapeboi 1)

Boomers dying (I think this is good for younger indebted people MoogZ 3 Grapeboi 2)

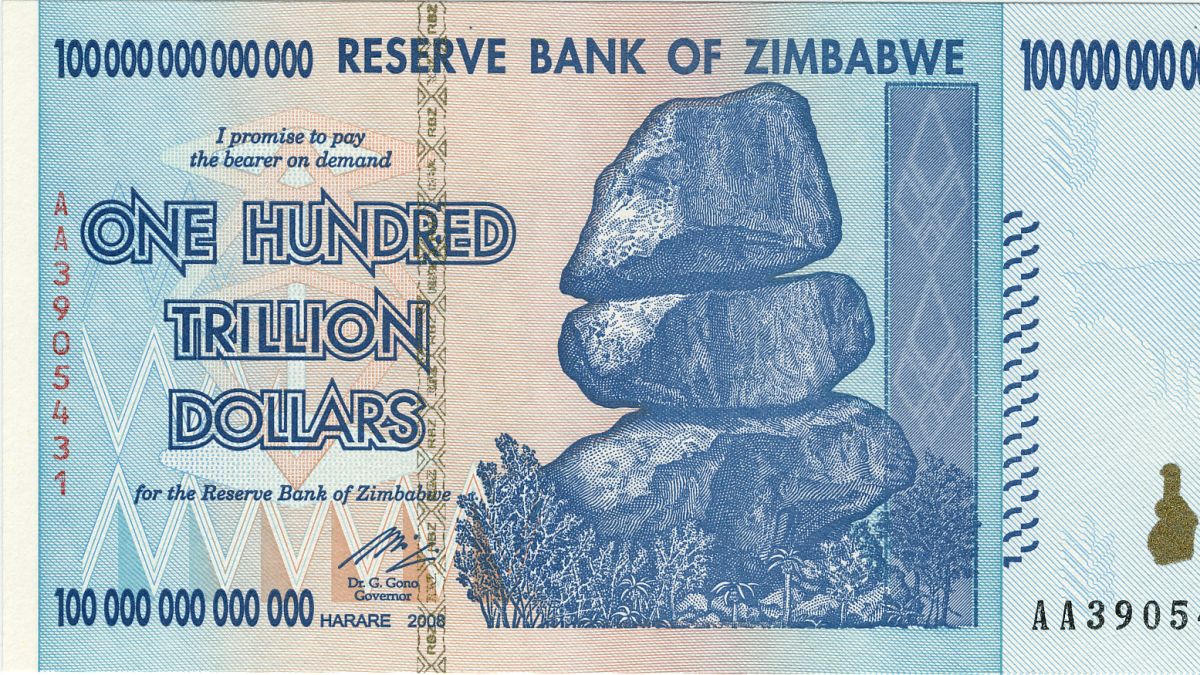

Inflation (MoogZ 4 Grapeboi 2)

How many people can pay their mortgage(s) if their spouse is unemployed? (MoogZ 5 Grapeboi 2)

How many people can pay their mortgage and the taxes or mortgage on their dead parents property? (They can sell it for a massive windfall, point Grapeboi)

I tally MoogZ 5 Grapeboi 3.

I think Casa stands a decent chance of being correct. It's a question of what effect will the next recession have on asset prices and will that pop a debt bubble. YMMV

If only there was a government run system in place to stabilize price increases to prevent rapid increases in inflation and the subsequent fall out.

Well we have a government-run system in place to stabilize price increases to prevent rapid increases in inflation and the subsequent fall out

AND to stabilize the unemployment rate.

The Fed has a dual mandate. They have 2.5 full years to try to raise rates before it'll be a political non-starter.

Personally I'd rather have people earning and spending lots of money vs 8-10% U5 unemployment.