Why is the top 1.1-19.9% income group not in that graphYES, TEXANS ACTUALLY PAY MORE IN TAXES THAN CALIFORNIANS

Data Source itep.org/whopays

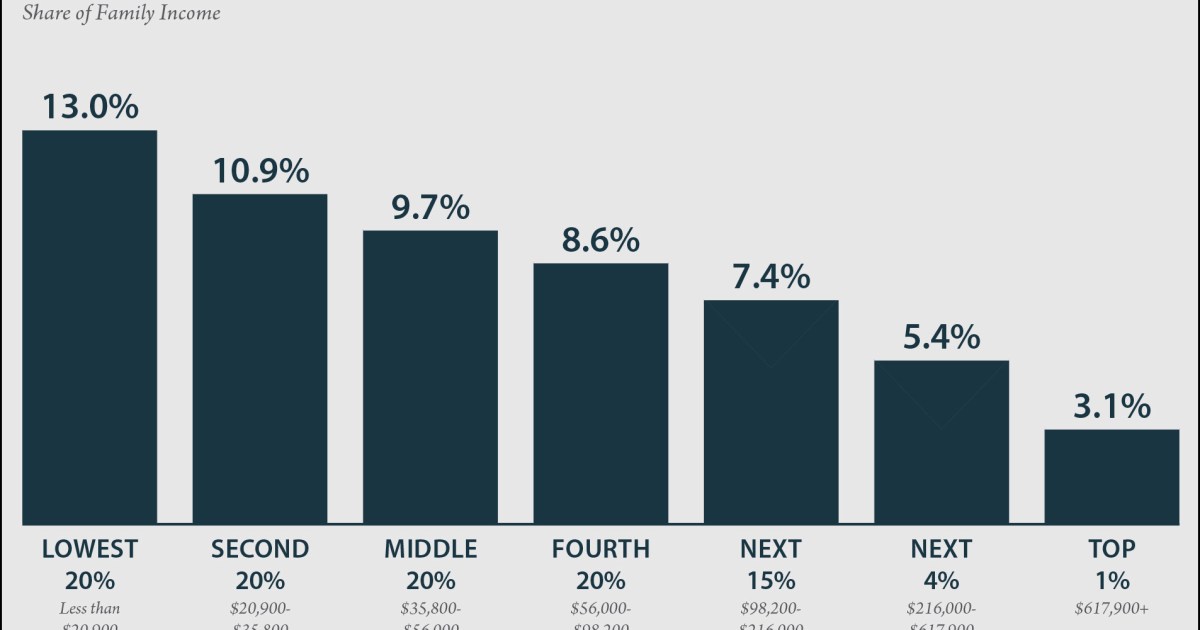

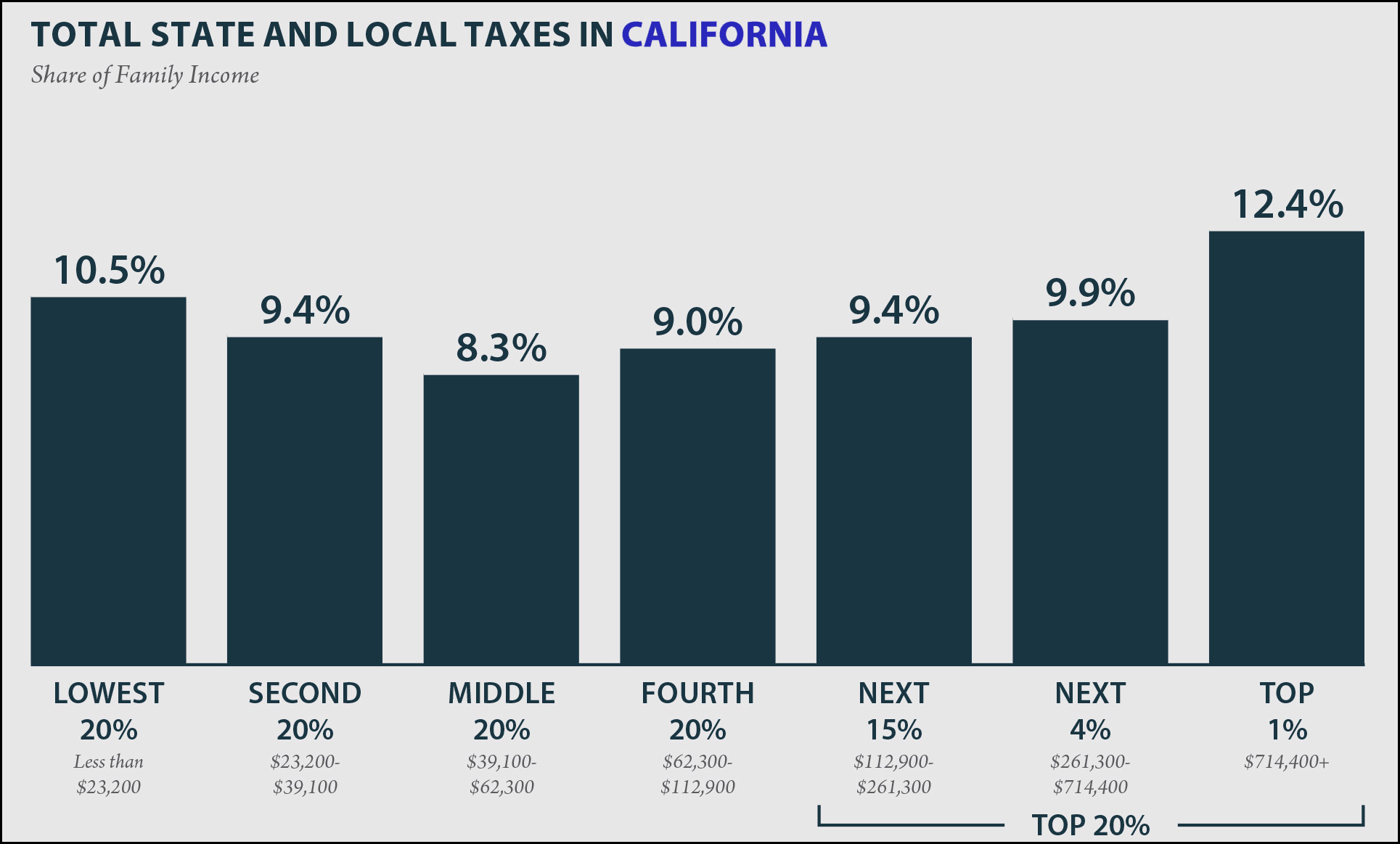

Texas politicians often tout how low their state taxes are, compared to “crazy liberal” states like California. What they actually mean, is that state taxes for the very rich are low, compared to states like California.

If you judge tax equity, by taxing the richest more than the poorest, then California has the most “equitable” state/local tax structure in the US. Texas has the 2nd least equitable tax structure in the country.

Texas is part of what the ITEP calls the “Terrible 10”:

IN THE 10 STATES WITH THE MOST REGRESSIVE TAX STRUCTURES (THE TERRIBLE 10), THE LOWEST-INCOME 20 PERCENT PAY UP TO SIX TIMES AS MUCH OF THEIR INCOME IN TAXES AS THEIR WEALTHY COUNTERPARTS. Washington State is the most regressive, followed by Texas, Florida, South Dakota, Nevada, Tennessee, Pennsylvania, Illinois, Oklahoma, and Wyoming.

ITEP or Institute of Taxation and Economic Policy, is a non-profit, non-partisan tax policy organization.

Now, if you’re skeptical about this report, and you’re thinking, “this sounds like liberal Californian propaganda”, well think again, The graphic reportedly contains 2018 data from the Institute of Taxation and Economic Policy (ITEP), which compiled statistics regarding IRS income tax, sales tax, property tax, and information from Bureau of Labor Statistics’ Consumer Expenditure Survey from sources including the U.S. Census Bureau, according to a report by the San Antonio Express News.

According to ITEP, Texans whose salaries fall into the lowest 20 percent of income earners (making less than $20,900 annually) pay about 13 percent of their income in state and local taxes. Meanwhile, Californians in the bottom 20 percent (making less than $23,200 annually) pay 10.5 percent. In Texas, the middle 20 percent of income earners ($35,800-$56,000) pay 9.7 percent in state and local taxes in contrast to middle-income Californians ($39,100-$62,300), who only pay 8.9 percent. Most glaringly, the top 1 percent of earners in Texas ($617,900 or more) pay 3.1 percent of their income in contrast to top earnings in California ($714,400 or more) who pay 12.4 percent.

Despite California being the fairest tax system in the country, CA’s tax system still isn’t really progressive, which exemplifies how regressive state and local tax structures in the US are across the board.

Probably because it would show that income group paying more taxes in California and less in Texas than the 60% middle. Especially given how steep the drop is in Texas.

No agenda there in that graph