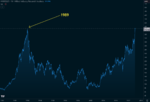

i've had a few shares of baba only since the pandemic, but it sure seems like 20 yearsWhat a trip seeing AMAT and AMSL…I owned these back in my mid 20’s in mid to late 1990’s….my whole thesis was own the supplier’s (drugs) fark Intc…made bank on both but should have just hold on.

The older I’ve become, buy and hold is piece of mind and Rad.…except for chines stocks.…first started with the Mathews Funds when they came out…then after holding Baba and bidu for 20 plus years it seams like, didn’t really make that much.

made a few bucks off of bidu and tencent early on but baba has not panned out....yet!