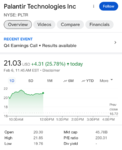

man if palantir got to 30-40bucks id be one very happy camper."A handful of times every decade there are tech companies that are so ahead of the competition and in a sweet spot of the future growth ... yet [Wall Street] at the time dismisses it by dusting off their long-term stubborn bear thesis and 30 spreadsheets," said Wedbush analyst Dan Ives.

Last night for Palantir was when this company went from an off-Broadway play to a prime-time theater right off of Times Square under the bright lights, " he added.

Open main menu button

REMINDER: THE ARENA PLATFORM, INC. has no obligation to monitor the Forums. However, THE ARENA PLATFORM, INC. reserves the right to review any materials submitted to or posted on the Forums, and remove, delete, redact or otherwise modify such materials, in its sole discretion and for any reason whatsoever, at any time and from time to time, without notice or further obligation to you. THE ARENA PLATFORM, INC. has no obligation to display or post any materials provided by you. THE ARENA PLATFORM, INC. reserves the right to disclose, at any time and from time to time, any information or materials that we deem necessary or appropriate to satisfy any applicable law, regulation, contract obligation, legal or dispute process or government request. Click on the following hyperlinks to further read the applicable Privacy Policy and Terms of Use.

How’s the stock market?

- Thread starter lagunaboy

- Start date

man if palantir got to 30-40bucks id be one very happy camper.

Ride the wave while you can. The trend is your friend!"A handful of times every decade there are tech companies that are so ahead of the competition and in a sweet spot of the future growth ... yet [Wall Street] at the time dismisses it by dusting off their long-term stubborn bear thesis and 30 spreadsheets," said Wedbush analyst Dan Ives.

Last night for Palantir was when this company went from an off-Broadway play to a prime-time theater right off of Times Square under the bright lights, " he added.

This article is an advertisement for the stock. It's marketing literature. If Palantir can grow the share price, it can hire more people and pay them with restricted stock units (RSUs) rather than add to their operating expenses. This would keep the era of "share price growth through hiring signals" going longer and prevent them from descending into the pit of "share price growth by operating expense reduction (layoffs) and M&A" the rest of the industry has suffered. Palantir appears to be attempting the former ("We're hiring thousands of Jews!") with an AI pump. They've obscured the fine details - notice the shell game with terms like "profits."

"Profits are up!" I ass-ume they mean, "Gross profits" which is different than net income which could actually be negative if they're doing a bunch of hiring and need to spend more to educate the customer (boot camps).

Growth phase, bro.

In a letter to shareholders, Chief Executive Alex Karp said: "For 2024, as a result of our sustained and growing profitability, we now see a path toward $800 million to $1 billion in adjusted free cash flow."Ride the wave while you can. The trend is your friend!

View attachment 172239

This article is an advertisement for the stock. It's marketing literature. If Palantir can grow the share price, it can hire more people and pay them with restricted stock units (RSUs) rather than add to their operating expenses. This would keep the era of "share price growth through hiring signals" going longer and prevent them from descending into the pit of "share price growth by operating expense reduction (layoffs) and M&A" the rest of the industry has suffered. As such, these articles always play a shell game with terms like "profits."

View attachment 172240

"Profits are up!" I ass-ume they mean, "Gross profits" which is different than net income which could actually be negative if they're doing a bunch of hiring and need to spend more to educate the customer (boot camps).

Growth phase, bro.

"We remain committed to building a business that will survive and thrive in any type of macroeconomic environment," he added. "As of the end of 2023, we maintained $3.7 billion in cash, cash equivalents, and U.S. treasuries, representing an increase of $1.1 billion from the year before."

AI Stock Palantir Rebuts Bears With Strong 2024 Guidance Amid Commercial Growth

PLTR stock jumped as 2024 revenue guidance came in above expectations amid strong growth expected in the commercial market.

What is Palantir's net income for FY2023? Adjusted free cash flow is yet another term.In a letter to shareholders, Chief Executive Alex Karp said: "For 2024, as a result of our sustained and growing profitability, we now see a path toward $800 million to $1 billion in adjusted free cash flow."

Edit: Ok, by "First annual profit" they appear to mean, "The first time Palantir's net income was in the black." Net income was $219 million on net revenues of around $2 billion.

Palantir Reports First Profitable Year, Citing Big AI Demand

Palantir Technologies Inc. shares soared by 31% on Tuesday after the company reported big demand for its artificial intelligence technology and gave a higher-than-expected profit outlook for 2024.

Last edited:

Palantir late Monday reported fourth-quarter earnings that met estimates while revenue topped Wall Street targets. Wedbush analyst Daniel Ives holds a buy rating on Palantir stock.What is Palantir's net income for FY2023? Adjusted free cash flow is yet another term.

"With a U.S. commercial business that grew an eye popping 70% in Q4 and commercial customer count that grew 44%, the AI revolution is driving AIP deal flow to a level we did not expect until 2025," he said in a report.

Further, Palantir rolled out its "Artificial Intelligence Platform" in early 2023.

“Palantir's Artificial Intelligence Platform is still in its infancy and already contributing in a meaningful way," said Bank of America analyst Mariana Perez Mora in a report. Mora noted specialized programs to get companies up to speed on AI capabilities.

She added: "The newest boot camp-like pilot approach is accelerating PLTR's go-to-market strategy and expanding its addressable market. Since launched last October, PLTR has completed 560+ AIP boot camps across 465 organizations. The company has run more than 200 use cases with AI applications across defense, healthcare, telecom, insurance, car rental, finance, pharma, manufacturing and others."

For the quarter ended Dec. 31, Palantir earnings using generally accepted accounting principles, or GAAP, were 8 cents a share, up 100% from a year earlier. Revenue rose 20% to $608 million, the maker of data analytics software said.

Analysts had predicted earnings of 8 cents a share on revenue of $603 million. Denver-based Palantir said government revenue rose 11% to $324 million, missing estimates of $333 million in sales. Commercial revenue rose 32% to $284 million, topping estimates of $271 million.

AI Stock Palantir Rebuts Bears With Strong 2024 Guidance Amid Commercial Growth

PLTR stock jumped as 2024 revenue guidance came in above expectations amid strong growth expected in the commercial market.

This didn't answer any of my questions. I found the answers myself. See my update.More redundant marketing hype

PLTR Stock Alert: Palantir Surges Double-Digits on Upbeat Q4 Results

PLTR stock is surging after Palantir reported estimate-beating revenue and showed that it was on track for profitability in the coming quarters.investorplace.com

What do you think Sentinel One (S)? Presently not cash positive, seems to still be in start up mode.

Last edited:

Owned it at one point. Decided it sucked, so I sold it and prob lost some money but rolled the rest into the other holding I had in the sector. Couldn’t remember what it was so I googled “Sentinel One vs”…What do you think Sentinel One (S)? Presently not cash positive, seems to still be in start up mode.

CrowdStrike vs SentinelOne | Cybersecurity Comparisons

Cut through the noise of an overcrowded cybersecurity industry and discover how CrowdStrike stacks up against SentinelOne.

And time says it was totally the right decision, CRWD has been straight fire and I bought as much of it as I could whenever possible to the point where on any given day it or PLTr are battling for the top spot in my holdings

Going forward it’s trading at an or close to all time highs so idk what to tell you other than cybersecurity is a good play in general?

Last edited:

On margin bro. You can’t loosebuy the dip?

Elon is going after Disney. Everyone knows he hates Bob Iger and the company.

He is funding Gina Carano's lawsuit against D, for kicking her off the show Madalorian.

Now Elon about to bring more lawsuits.

He is funding Gina Carano's lawsuit against D, for kicking her off the show Madalorian.

Now Elon about to bring more lawsuits.

lol Disney isn’t afraid of Elon, particularly in this case. This is a sure fire loser.Elon is going after Disney. Everyone knows he hates Bob Iger and the company.

He is funding Gina Carano's lawsuit against D, for kicking her off the show Madalorian.

Now Elon about to bring more lawsuits.

Last edited: