Right but I'm talking on a broader scale.

Take me for instance.

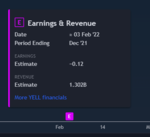

All the data on Omicron seemed to be pointing in a good direction over the past weeks (despite the media panic) and looking at historical prices for Carnival/CCL the other day made me to speculate it was a good buy.

Now I'm up 19%.

People didn't used to throw around money in the market like this. And not from their smartphone.

And there are millions more just like me that have piled money into garbage like DoorDash.

There have to be a lot of people doing this because it's so much easier now. How much money they all actually account for....

I started because thinkorswim had a fun, easy paper trading app. I saw in passing, and by accident, that carnival stock had taken a shlt and I thought they weren't going to go bankrupt and everyone was over reacting.

So I "bought" a bunch of that (half of the 100k points they give you) and it went up ~25% over a couple of weeks. I kept doing that with other companies based on news events. One or two at a time.

I used the other half to buy stuff like Nvidia, lulu lemon, random crap like that one at a time when the market opened, selling it as soon as it went down and buying into one of the others. I made a list of stocks that moved a lot, and had a lot of people buying in and out. I always sold those before the market closed, was just playing them that day, not really sure about their long term...thing. That part was fun.

Now for a while it's been my money and I'm just doing the same, probably recklessly irresponsible, thing...treating it like a game.

I don't know though, I've been playing games my whole life and I'm good at almost all of them. Video game generation might be able to make some waves, eventually.

Edit: I get a lot of my picks from this thread, I owe some of you some waves and beers

Last edited: